Why Hire an Online Bookkeeper and Accountant?

Ready to take bookkeeping off your plate? Here are 8 reasons to hire an online bookkeeping and accounting team and free up your time for growth.

Ready to take bookkeeping off your plate? Here are 8 reasons to hire an online bookkeeping and accounting team and free up your time for growth.

Explore the fundamentals of crypto assets, their operation, and tax considerations for Australian investors.

A clear guide for Australian residents on managing foreign income tax obligations, reporting requirements, and avoiding double taxation.

Understand how the NDIS affects your tax, what income is exempt, and your obligations if you hire or provide services.

Understand how tax fraud scams in Australia work, how to spot fake messages, and how to protect your myGov account today.

We explore smart tax reducing strategies for small business owners and franchisees across Australia. From timing your deductions to super contributions and maximising available tax offsets, discover ways to stay compliant while keeping more of your hard-earned money.

The small business energy incentive provides a 20% bonus tax deduction for eligible SMEs investing in energy-efficient upgrades and improvements.

Australia’s luxury car tax thresholds for 2024–25 have been updated, affecting both fuel-efficient and other vehicles. This guide breaks down the new rates and what they mean for buyers.

Early access to super is strictly regulated. SMSF trustees must understand the legal grounds, potential risks, and their responsibilities to avoid penalties.

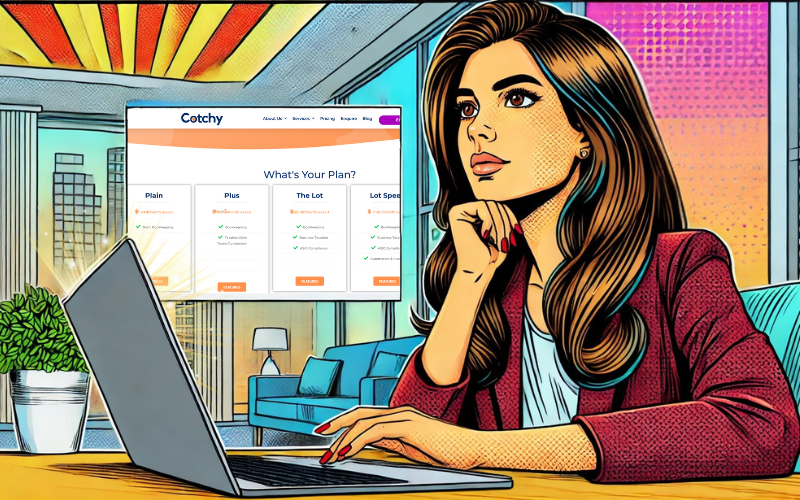

Find out how Cotchy small business accounting and bookkeeping services can streamline your finances, ensure compliance, and support long-term success for Australian businesses.

Understanding the ATO’s focus areas is crucial for small businesses aiming to maintain compliance and optimise tax practices.

Stay compliant and audit-ready with our essential guide to record-keeping for not-for-profits. Understand the key documents every organisation must maintain.